Not only banks, but also building societies are known to run mortgage deals at certain times of the year. Research: Take the time to do your research and look at the other possible lenders around you.Remember, if you fail to make your repayments you may lose your home. Loan Security: Make sure that you read every fine detail on your loan contract.

Before taking out a mortgage, make sure that you will be able to pay it off in the long run. If you take on a mortgage that you can't afford and didn't even consider the other options, it's your own fault.

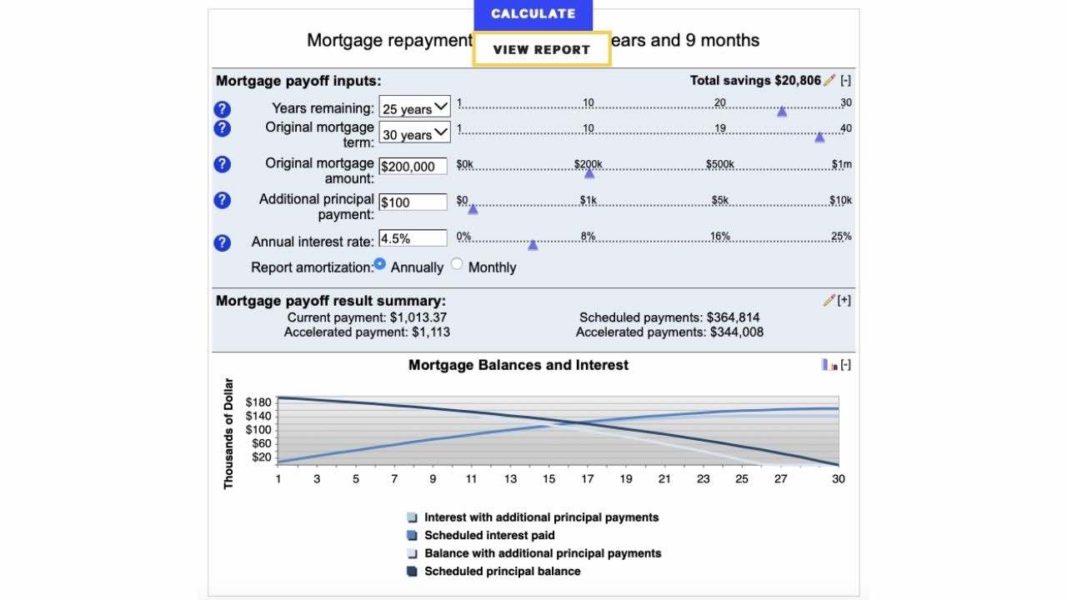

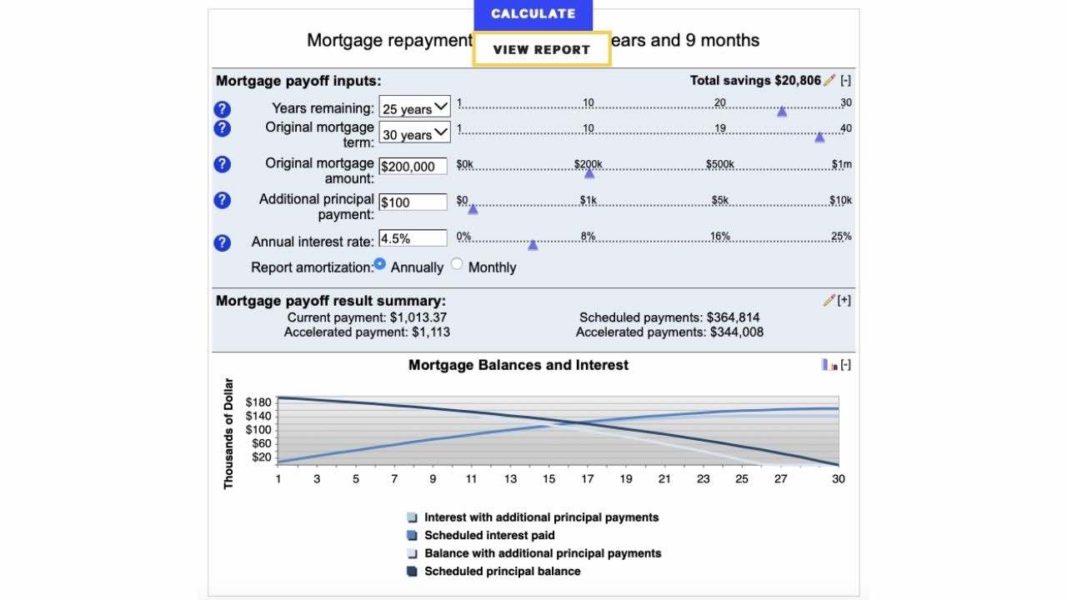

Affordability: Make sure you can afford the mortgage. Things to Consider Before Taking Out a Mortgage Try our Additional Monthly Payments Calculator and check out the results for yourself. Even something as low as £50.00 extra a month can make a big difference in the end. Loan overpayments are a fantastic idea, if you can do it. If you begin to think that you can pay more on a monthly basis and cut down your interest costs, make sure that you can back up that thought with some proof, otherwise you may take on something you can't actually do. For example, if you are looking at a long-term mortgage, then take a step back and look at what you can afford. When you begin budgeting yourself for a mortgage, don't over-stretch yourself. Our Early Repayment Loan Calculator provides you with a variety of monthly interest periods such as 1 year, 2 years, 3 years, 4 years, 5 years and 10 years, as well as the ability to compare them on the monthly repayment basis that you choose. Using our early repayment loan calculator will allow you to calculate the monthly interest repayments that you will be making over the different time periods as well as helping you define whatever the best financial option for you will be. Remember, a mortgage is a long-term loan that will have a large impact on your life, so think carefully. Take some time to think about it, and consider all of your options. Not jumping straight into the mortgage.

This is important so that you understand what you're getting into. Reviewing the considerations of the personal loan before you sign the agreement.Using the loan calculator in order to see the monthly loan repayment amounts depending on the term and interest rates of each loan.If you are considering taking out a mortgage, then it is important that you think about: Considerations When Repaying Your Loan Early

0 kommentar(er)

0 kommentar(er)